Last year at this time we celebrated the 100th anniversary of our brand symbol, the crane, which coincided with the most successful year in our company’s history. By refreshing our brand image, we have begun a new chapter in the history of the Lufthansa Group. The modern design embodies our combination of tradition and innovation and underlines our aim of setting standards in our industry.

Last year we already aligned the appearance of all our financial publications towards this new design. Now we are pleased to provide you with the first issue of our new Shareholder Information. It will be published on our website four times a year, simultaneously with the release of the financial results. All shareholder registered for our online services for shareholders still receive the Shareholder Information by e-mail, but now in form of a modern newsletter.

Dear Shareholders, in 2018 our financial results fulfilled the aim mentioned above: The Lufthansa Group was one of the few companies in the sector to have achieved the targets set at the start of the year. Despite numerous challenges, the result was almost on par with the previous year. Integration costs at Eurowings in connection with the takeover of significant parts of Air Berlin, irregularities in flight operations and much higher fuel costs added up to a massive financial burden. Profitable growth and efficiency gains nevertheless enabled us to compensate for most of these adverse effects.

Our appreciation of these good figures is clouded, however, because 2018 was an ambivalent year. We did not always live up to our premium promise to our customers, and disappointed many of our passengers with delays and flight cancellations. The entire air transport industry – from the airlines to airports and air traffic control – revealed operating weaknesses last year as a result of disproportionate growth in air traffic. We reacted promptly and are working with our partners to find good, fast solutions for our customers. Altogether we have defined more than 400 individual measures, which are the responsibility of the specially introduced Executive Board function for Airline Resources & Operations Standards.

All this is intended to encourage our customers to refocus on what sets us apart from our competitors: our high-quality product, which in Europe at least has no equal. In future, we want to give our passengers even more individual service in order to represent their personal needs even better. It starts with little things that betoken a premium experience in a given situation, but also includes innovations that will set new standards in our market segment. In direct traffic, we want to make Eurowings what we already are with Network Airlines: the leading European airline in its segment.

Dear Shareholders, our airlines are leaders in Europe’s strongest markets. This has also put us in a strategic position for future profitable growth. We are therefore confident that we will be able to continue increasing the value of our company going forward. The title of this year’s annual report, “Striving for excellence” puts it very well: We want to set standards in our industry – for the good of our shareholders and all our stakeholders.

We would be pleased if you would continue to accompany us on this journey.

Head of Investor Relations

Deutsche Lufthansa AG

Revenue €m

Adjusted EBIT €m

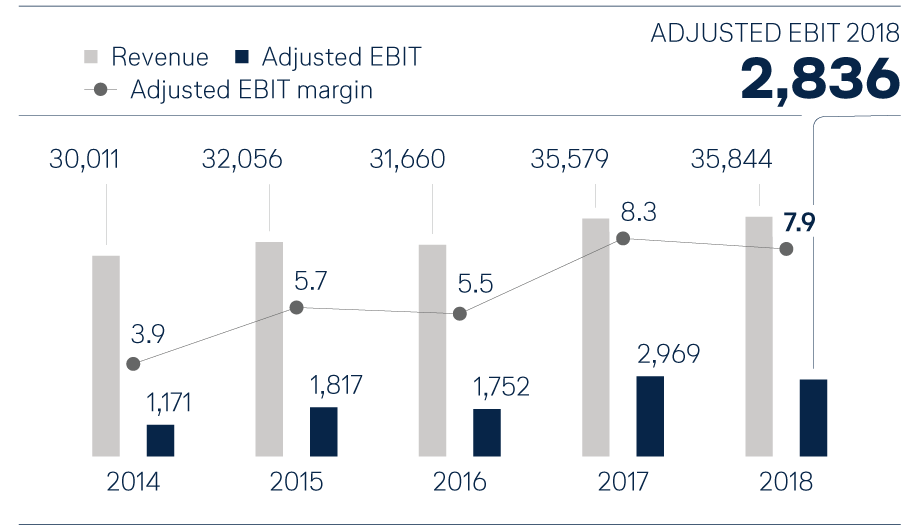

The Lufthansa Group again reported strong growth in 2018. The airlines in the Lufthansa Group carried a total of 142 million passengers, more than ever before. New highs were also achieved in terms of capacity, sales and passenger load factor. Revenue increased by 1% to EUR 35,844m. After adjusting for the effects of first-time application of the accounting standard IFRS 15 (Revenue from Contracts with Customers), revenue increased by 6%. Adjusted EBIT for the Group saw a decline of 4% year-on-year to EUR 2,836m (previous year: EUR 2,969m). The Adjusted EBIT margin fell by 0.4 percentage points to 7.9%. On a like-for-like basis, adjusted for changes to the accounting standards, Adjusted EBIT came to EUR 2,714m and so was 9% down on the previous year.

The cause of the earnings decline was losses at Eurowings, primarily in connection with high non-recurring expenses for integrating the aircraft acquired from Air Berlin into the fleet. The earnings of Network Airlines and Aviation Services were up on the previous year, however. Considerable unit cost reductions and profitable growth at Network Airlines were more than able to compensate for higher fuel costs and other expenses due to irregularities in flight operations.

At year-end 2018, Lufthansa again had a strong balance sheet. Gearing of 1.8 remained significantly below the upper limit of the target corridor, which is 3.5. Its strong balance sheet enables the Group to keep on investing in its strategic development. As a result, a wide range of innovative products was introduced in the air and on the ground in 2018, supported by the ongoing modernisation of the fleet. Eurowings completed an important step towards consolidating the European market by integrating key parts of the former Air Berlin fleet. A new wage agreement signed with ground staff also ensures that long-term industrial relations remain settled.

Development Revenue, Adjusted EBIT €m

Adjusted EBIT margin in %

| 2018 | 2017 | Change in % | ||

|---|---|---|---|---|

| Total revenue | €m | 35,844 | 35,579 | 1 2) |

| of whichtraffic revenue | €m | 28,103 | 28,399 | -1 3) |

| Operating expenses | €m | 35,466 | 35,355 | 0 4) |

| Adjusted EBITDA | €m | 5,016 | 5,009 | 0 |

| Adjusted EBIT | €m | 2,836 | 2,969 | -4 |

| EBIT | €m | 2,974 | 3,297 | -10 |

| Net profit/loss | €m | 2,163 | 2,340 | -8 |

| 2018 | 2017 | Change in % | ||

|---|---|---|---|---|

| Total assets | €m | 38,213 | 35,778 | 7 |

| Equity ratio | % | 25.1 | 25.5 | –0.4 pts |

| Net indebtedness | €m | 3,489 | 2,884 | 21 |

| Pension provisions | €m | 5,865 | 5,116 | 15 |

| Cash flow from operating activities | €m | 4,109 | 5,368 | -23 |

| Capital expenditure (gross) 5) | €m | 3,757 | 3,474 | 8 |

| Free cash flow | €m | 250 | 2,117 | -88 |

| 2018 | 2017 | Change in % | ||

|---|---|---|---|---|

| Adjusted EBITDA-Marge | % | 14.0 | 14.1 | –0.1 P. |

| Adjusted EBIT-Marge | % | 7.9 | 8.3 | –0.4 P. |

| EBIT-Marge | % | 8.3 | 9.3 | –1.0 P. |

| ROCE | % | 11.1 | 13.2 | –2.1 P. |

| Adjusted ROCE | % | 10.6 | 11.9 | –1.3 P. |

| 2018 | 2017 | Change in % | ||

|---|---|---|---|---|

| Share price at year-end | € | 19.70 | 30.72 | –36 |

| Earnings per share | € | 4.58 | 4.98 | –8 |

| Suggested dividend per share | € | 0.80 | 0.80 | – |

| 2018 | 2017 | Change in % | ||

|---|---|---|---|---|

| Employees as of 31.12. | number | 135,534 | 129,424 | 5 |

| Average number of employees | number | 134,330 | 128,856 | 4 |

| 2018 | 2017 | Change in % | ||

|---|---|---|---|---|

| Flights | number | 1,228,920 | 1,128,745 | 9 |

| Passengers | tsd. | 142,335 | 129,345 | 10 |

| Available seat-kilometres | millions | 349,489 | 322,875 | 8 |

| Revenue seat-kilometres | millions | 284,561 | 261,149 | 9 |

| Passenger load factor | % | 81.4 | 80.9 | 0.5 P. |

| Available cargo tonne-kilometres | millions | 16,431 | 15,754 | 4 |

| Revenue cargo tonne-kilometres | millions | 10,907 | 10,819 | 1 |

| Cargo load factor | % | 66.4 | 68.7 | -2.3 P. |

1) The figures for 2017 and 2018 shown here include effects from the first-time application of new accounting standards and other accounting changes. Detailed explanations are provided on p. 29f. of the Annual Report 2018.

2) Without IFRS 15 effect: 6 %.

3) Without IFRS 15 effect: 7 %.

4) Without IFRS 15 effect: 7 %.

5) Without acquisition of equity investments.

6) Previousyear’sfigureshavebeenadjusted.

Date of publication: 14 March 2019.

The performance of the Lufthansa share in 2018 was marked by profit taking following strong price rises in the previous year, as well as uncertainty in connection with slower macroeconomic growth, trade wars, rising oil prices and greater competition on continental European routes. In the first half-year, the share fell by 33%. Following half-year results that were slightly above market expectations, the price recovered somewhat in the third quarter, rising by 3% over the period. In the final quarter, the price of the Lufthansa share declined by 7%, driven chiefly by concerns about trade wars and the ongoing Brexit negotiations, and followed the general performance of the DAX, which was down by 14% in the fourth quarter.

The share reached its high price for the year on 3 January 2018 at EUR 30.90, followed by the low for the year on 30 October 2018 at EUR 17.31. As of year-end, the Lufthansa share traded at EUR 19.70. This represents a fall of 36% in financial year 2018. As a result, performance continued to lag behind that of the DAX index, which fell by 18%. However, performance largely reflected trends in the European airline industry as a whole, in which the shares of the main competitors also sustained losses of over 20%.

For the financial year 2018, there was a net profit at Deutsche Lufthansa AG of EUR 339m. Following the transfer of EUR 41m from retained earnings, distributable profit comes to EUR 380m.

In line with the dividend policy, the Executive Board and Supervisory Board will table a proposal at the Annual General Meeting on 07 May 2019 to distribute a dividend of EUR 0.80 per share to shareholders for the financial year 2018. This represents a total dividend of EUR 380m or 12.8% of EBIT for 2018.

The Lufthansa Group will be focusing in 2019 on achieving sustainable quality growth. Therefore, the Group is further reducing the capacity growth for its airlines for the upcoming summer to 1.9 percent. Despite this, the Group expects to report mid-single-digit percentage annual revenue growth.

Cost reductions will make a sizeable contribution to offsetting the EUR 650 million of additional costs that are expected to be incurred by the airlines owing to higher fuel costs. Overall, the Group expects to post an Adjusted EBIT margin for the year of between 6.5 and 8.0 percent. Eurowings is expected to achieve a breakeven Adjusted EBIT, which would be a substantial improvement on its 2018 earnings result.

On 14 March 2019, the Lufthansa Group published its Annual Report for the financial year 2018. The title of the report, “Striving for excellence”, clearly reflects the objective: The Lufthansa Group wants to set standards in its industry – for the benefit of its shareholders, customers and employees.

This is achieved through a consistently positioning as a premium airline. With a diverse range of measures aimed at maintaining future viability, the value of the brand and the Company shall be sustainably strengthened. This striving for excellence can be seen in many ways at Lufthansa Group – in numbers, innovations and successes. An attractive selection can be found in our online Annual Report.

On 4 December 2018, the Supervisory Board of Deutsche Lufthansa AG voted to expand the Executive Board by adding a new area of responsibility, Airline Resources & Operations Standards, as of January 2019. This pools vital functions such as fleet management, flight operations standards, ground operations standards, infrastructure, system partners and Group safety at the Executive Board level.

Detlef Kayser, previously Executive Vice President Strategy and Fleet, has taken responsibility for the new role. His contract is valid for three years until 31 December 2021.

With New Premium, the Network Airlines of Lufthansa Group create a new common premium standard. Because every customer is unique and has very individual preferences and expectations, nowadays premium is more than only champagne and caviar. New premium is simpler, friendlier and more personal. The key factor is what the customer regards as premium. In a competitive environment with luxury carriers at one end and low-cost airlines at the other, the Network Airlines of the Lufthansa Group must define premium in a way that distinguishes them from their competitors.

New Premium is created by two types of experiences: Those that are apparent at first sight, and those that reveal themselves in very special moments of surprise, delighting customers. “Brilliant Basics” and “Magic Moments”.

Uncomplicated booking, faster check-in, tasty food, reliability and comfort: All of these are basic services that customers expect. In highest quality, they become Brilliant Basics. With Magic Moments, we redefine customer appreciation: Problems are resolved before they arise, and customers are delighted by individual, personal treatment. This can be an attentiveness that is both simple and unique, such as a hand-written birthday greeting placed on their meal tray. These Magic Moments, and others besides, can be experienced at all of the Lufthansa Group’s premium airlines – along the entire travel chain and not just on board.

Lufthansa Group will be significantly expanding its tourist-oriented long-haul portfolio at its hubs in Frankfurt and Munich. After the successes of Edelweiss in Zürich and the deployment of the first few Eurowings long-haul aircraft departing from Munich, there will now also be flights available from Frankfurt, along with an increase in flights from Munich. For Frankfurt Airport, this means that, as of Fall 2019, Eurowings will be taking off from the metropolis on the Main river.

As a first step, Eurowings will offer flights from Frankfurt to the popular vacation islands Mauritius and Barbados when the winter flight schedule goes into effect in October 2019. In addition to this, there will also be flights to Windhoek in Namibia, with other destinations currently being planned.

From the Munich hub, Eurowings has already been successfully offering long-haul connections to a selection of tourist destinations since Summer 2018. In the 2019/2020 winter schedule, Eurowings will also be connecting the Bavarian capital with Bangkok (Thailand). Connections from Munich to additional flight destinations are currently being planned.

On 28 January 2019, the Lufthansa Innovation Hub (LIH) opened its first foreign office in Singapore.

The expansion of the aviation group’s digitalization and innovation unit, established in 2014, is a strategic response to the rapidly increasing importance of the Asian technology sector for the future of travel and mobility. The focus of the LIH Singapore will initially be on an in-depth exploration of specific market developments in the context of the digitalization of travel and mobility, as well as on establishing a network of relevant tech players and the first strategic partners on site. This is the first initiative of its kind by a Western airline on the Asian continent. A first alliance with INSEAD, one of the world's leading business schools, has already been launched.

The opening of an additional office in Shanghai, China is planned over the course of the year. The move to Asia with a focus on new, digital business models is part of the Lufthansa Group's digital strategy, which envisions a decisive expansion of digital activities along the entire travel and mobility chain as well as building a sus-tainable network with leading technology players.

The interest in sustainable alternative fuels is very high. Thus, the use of alternative fuel creates new perspectives for improving the CO2 balance. The Lufthansa Group is therefore working hard to ensure that these fuels are used to a greater extent in the future. To this end, the group is active in various research institutions and industry associations.

On 14 February 2019 a letter of intent was signed with Heide refinery (Raffinerie Heide) for the production and use of synthetic kerosene. Lufthansa Group has had a business relationship with Raffinerie Heide for many years. Now, an important step into future has been taken with this letter of intent. Specifically, it is planned to fly from Hamburg with environmentally friendly synthetic kerosene produced by Raffinerie Heide. The regenerative fuel is to be produced by using surplus of regionally generated wind energy. Hamburg Airport is also a partner.

We are at your disposal to answer your questions.

Head of Investor Relations

Analyst and Investor Communication

Information published in this Shareholder Information with regard to the future development of the Lufthansa Group and its subsidiaries consists purely of forecasts and assessments and not of definitive historical facts. Its purpose is exclusively informational and is identified by the use of such terms as ‘believe’, ‘expect’, ‘forecast’, ‘intend’, ‘project’, ‘plan’, ‘estimate’, ‘assume’ and ‘endeavour’. These forward-looking statements are based on all discernible information, facts and expectations available at the time. They can, therefore, only claim validity up to the date of their publication. Since forward-looking statements are by their nature subject to uncertainties and imponderable risk factors – such as changes in underlying economic conditions – and rest on assumptions that may not, or divergently occur, it is possible that the Group’s actual results and development may differ materially from those implied by the forecasts. The Lufthansa Group makes a point of checking and updating the information it publishes. It cannot, however, assume any obligation to adapt forward-looking statements to accommodate events or developments that may occur at some later date. Accordingly, it neither expressly nor conclusively accepts liability, nor gives any guarantee for the actuality, accuracy or completeness of this data and information.

The Lufthansa Group is a global aviation group with a total of more than 580 subsidiaries and equity investments.

Corporate responsibility, that is to say sustainable and responsible entrepreneurial practice, is an integral part of our corporate strategy. It means that we are committed to creating added value for our customers, employees and investors and to meeting our responsibilities toward the environment and society.

Current news from the Lufthansa Group

Detailed financial information