Dividend policy

The Lufthansa Group’s dividend policy is to distribute to its shareholders 20% to 40% of net profit, adjusted for non-recurring gains and losses. One condition for the payment of a dividend is that the net profit for the year as shown in the individual financial statements of Deutsche Lufthansa AG that are drawn up under German commercial law allows for a distribution of the relevant amount.

Deutsche Lufthansa AG reported a net profit of EUR 372 million for the 2024 financial year. Following the transfer of EUR 13 million to retained earnings, the distributable profit comes to EUR 359 million.

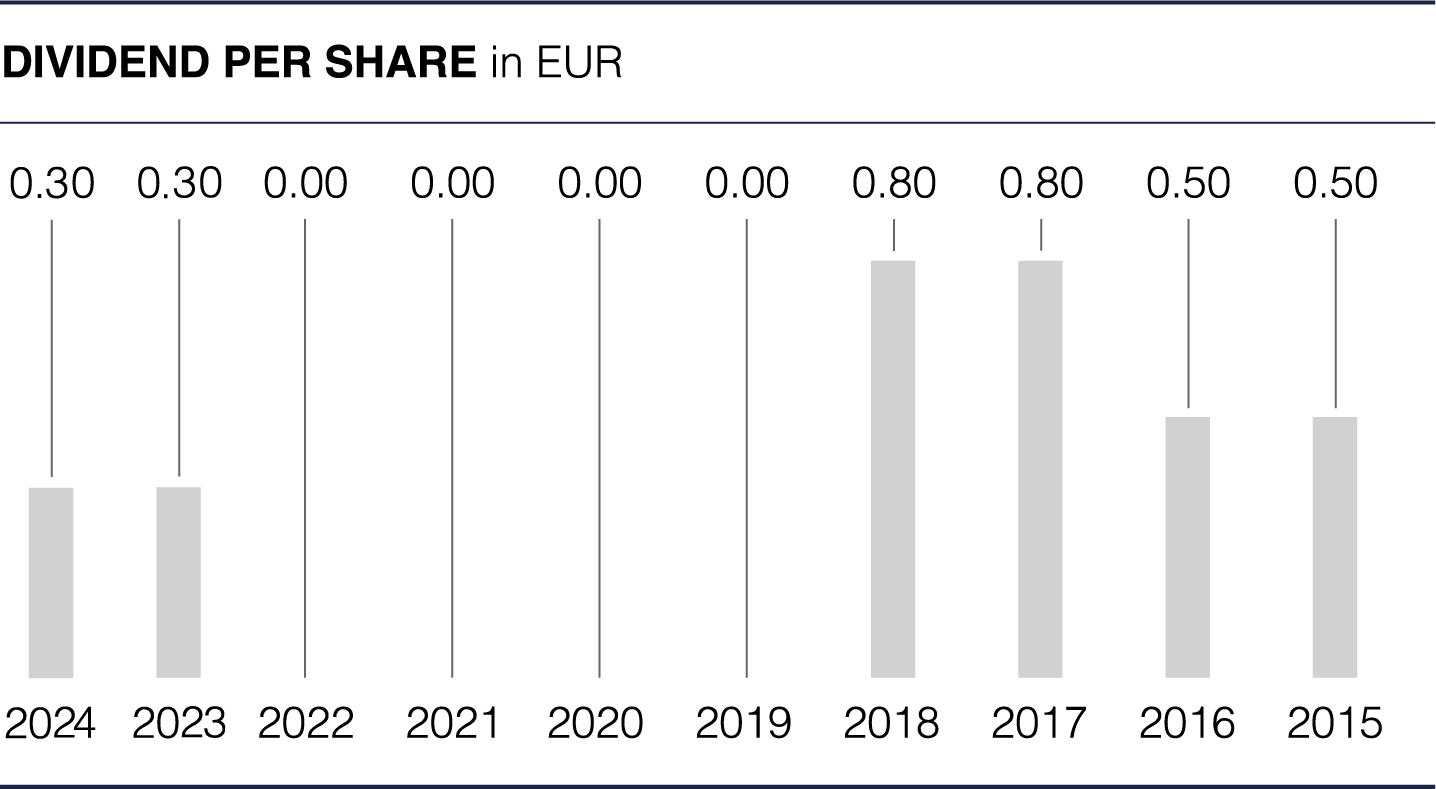

At the Annual General Meeting on 6 May 2025, the Executive Board and the Supervisory Board of Deutsche Lufthansa AG will propose the distribution of a dividend of EUR 0.30 per share for the financial year 2024. This represents a total dividend payout of EUR 359 million or 26 % of the net profit for 2024 and therefore a higher percentage than in the previous year, when 21 % of the net profit was distributed. Based on the Lufthansa share price at the end of the year, this results in a dividend yield of around 5 %.

Shareholders should regularly participate directly in the Company's success via an attractive dividend. This is intended to make the Company more attractive on the capital market, including for investors with a long-term investment horizon.